Standardize the Work, Don’t Lose the Nuance: Can The New ‘Pay for Success’ Models Replicate Into Functional Utility?

The social impact sector in developed and developing countries needs to innovate their financing structures so that the rising demand for social intervention programming is matched by an expanding supply of capital. The ‘pay for success’ Social Impact Bond (SIB) is one of the frontier efforts of the innovative finance field, which holds the powerful potential to facilitate relationships that motivate partnerships and increase funding that addresses a shared mission. The types of deals which fall under the ‘pay for success’ models have thus allowed the circumstances of the arrangements to dictate the partnership structure. While this breadth is expected and necessary for an innovative concept to test its limits, utility and efficacy, the next wave of engaged practitioners need to take the initiative to evaluate these piloted models within their situational context and create a ‘standardized’ set of practices which respects unique deal circumstances so that the pay for success models can overcome their greatest current barrier to replicability: complexity.

The Social Impact Bond is one of the more widely known ‘pay for success’ models that allows the private sector to inject needed capital into the social impact space by prioritizing the double bottom line of positive fiscal performance and social benefit within the deal structure. The models, briefly explained further below, theoretically satisfy all parties involved in the arrangement, capitalizing on what has traditionally been seen as an inherent contradiction between the private sector and social impact programs – profitability. But will these models achieve their goals in a replicable manner? Can they overcome the dichotomy of that contradiction without losing sight of all involved parties’ objectives?

The ‘Simple’ Model

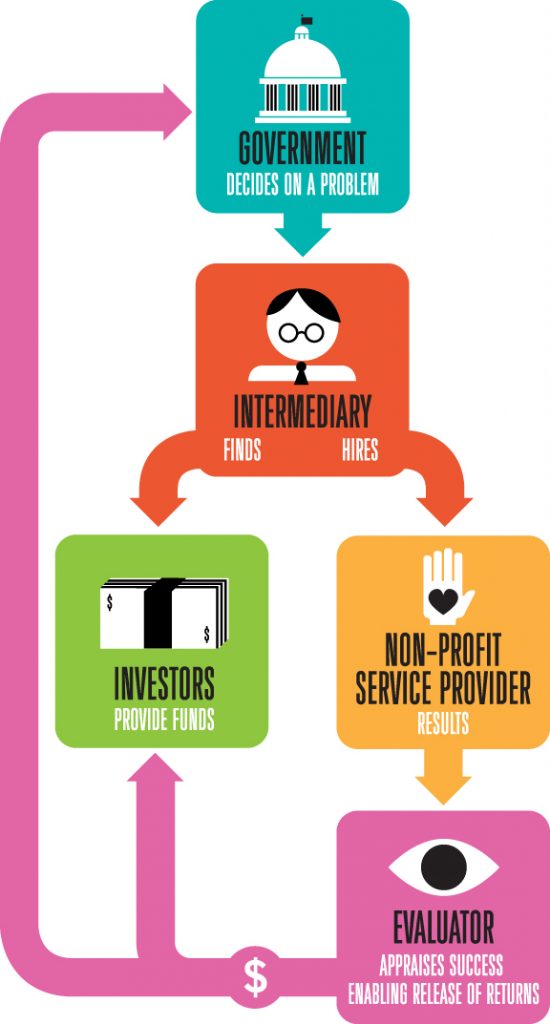

The simplest model of these ‘pay for success’ Social Impact Bonds is as follows: the government contracts an intermediary (usually) who then facilitates the relationship between the investor, a service provider, and the government. The investor supplies the capital for the program, the service provider is contracted to run it and, if certain agreed upon benchmarks (success measures) are met as determined by a third party monitor (usually), the government (also known as the broader ‘outcome funder’) pays the investor the cost of the initial project, plus interest and/or additional success incentives. If the project fails, and/or it does not meet expected benchmarks, the government does not pay the investor. The roles of players in the SIB model are fairly straightforward, but the intricacy of the structural details, and the variety of SIB deal models do not yet allow for a normalized methodology. Given SIBs relative newness to the social impact space (the first SIB was announced in 2010 and today roughly 80 are in the design and implementation stage), a lack of faith and comprehension is not unexpected.

The simplest model of these ‘pay for success’ Social Impact Bonds is as follows: the government contracts an intermediary (usually) who then facilitates the relationship between the investor, a service provider, and the government. The investor supplies the capital for the program, the service provider is contracted to run it and, if certain agreed upon benchmarks (success measures) are met as determined by a third party monitor (usually), the government (also known as the broader ‘outcome funder’) pays the investor the cost of the initial project, plus interest and/or additional success incentives. If the project fails, and/or it does not meet expected benchmarks, the government does not pay the investor. The roles of players in the SIB model are fairly straightforward, but the intricacy of the structural details, and the variety of SIB deal models do not yet allow for a normalized methodology. Given SIBs relative newness to the social impact space (the first SIB was announced in 2010 and today roughly 80 are in the design and implementation stage), a lack of faith and comprehension is not unexpected.

The Social Impact Bond is the most replicated pay-for-success/impact model thus far, but its structure is fluid and its applications are defined much more by the details of the transactions between the different parties than by the core principles of the SIB model. While that fluidity allows for necessary nuance particular to each deal, it also inhibits the approachability of the structure, limiting its replicability, and ultimately, its utility. The infographic above, How Social Innovation Financing Works by Dan Stiles, offers a basic representation of this model, which illustrates the central transactions between the parties and intentionally skips over the many and often rather complicated transaction details that are found when the SIB is actually applied.

Why Engage in an SIB Partnership?

What do you offer often silo-ed funders (public and private) so that they’ll step out of their established practices and engage in a pilot program whose multiple players raise the risk of mission creep? Risk transfer. Risk transfer is fundamental to any SIB structure because it gives frontier capital funders (often the SIB investor) an opportunity to make back their loan, and for the more traditional mid-stage lenders (SIB outcome funders), the security of only becoming financially responsible for success.

One of the variations on the SIB model is the Development Impact Bond (DIB), a structure that makes the ‘pay for success’ model more viable in developing countries whose governments have shallower pockets and less capacity to implement innovative programs. The DIB replaces (at least in part) the role of the government as the outcome funder, with a private sector entity, although as originally envisioned the government is still meant to be involved on some level. A pilot DIB, launched in 2014 is being implemented in Rajasthan, India, brings together the Children’s Investment Fund Foundation (CIFF – outcome funder), Educate Girls (service provider) and UBS Optimus Foundation (investor). This pilot, whose programmatic efficacy has yet to be determined, was successful in overcoming the implementation barriers still daunting many ‘pay for success’ enthusiasts through risk transfer and leveraged capital.

CIFF – who in this case represents an entity who may have been hesitant to fund a million-dollar pilot – has the peace of mind that it is only financially responsible for a successful program. UBS Optimus – who represents an organization that may be more likely to invest in riskier enterprises at an earlier stage, thus accepting inevitable occasional loss – gains a welcome higher guarantee return on investment capital. Further, CIFF and UBS Optimus together provide capital that Educate Girls, a service provider, might not have otherwise been able to mobilize. Ultimately, this partnership benefits the underserved in Rajasthan, jointly aligning the collaborating organizations’ missions. The three entities together divide the risk of failure and share in the spoils of success through a leveraged capital structure that introduced new funding into the sector.

While this successfully implemented model does not formally incorporate the local government, it has the potential to serve as the proof-of-concept needed to galvanize the public sector into subsequent DIB iterations/replications. If the public sector becomes more active in these arrangements, the associated complications will necessitate another round of DIB piloting and extensive logistical reframing.

But, what should also be considered is the more controversial question of whether the government really must be involved in this type of work or if it is “enough” to mobilize private sector investment that would otherwise have been inaccessible? Although public sector involvement is integral to the ‘pay for success’ models in countries with higher capacity governments, it may not be necessary for developing countries, and may impede the agreement evolutions and iterations which will allow practitioners to develop a set of situational best practices.

How to Create ‘Pay For Success’ Deal Replicability?

How can practitioners drive these deals forward and help them evolve to become more ‘user-friendly’ without losing their strategic fluidity, which allows them to adapt and address a variety of developed and developing countries’ challenges? These models would ideally drive social impact financial innovation, forcing an exploration of new opportunities for ‘pay for success’ utilization, concurrently drawing productive conclusions from successful applications, with particular regard for circumstantial differences that allow for favorable outcomes.

Propelling the social impact sector’s involvement with the ‘pay for success’ models has already led to intriguing developments in the space. Fellow ANDE member Yunus Social Business and the Rockefeller Foundation are pioneering the Social Success Note, which de-prioritizes government involvement, incorporates private sector investment and still transfers risk from the investor to the outcome funder. This approach continues to uphold the fundamental ‘pay for success’ tenants while also ultimately alleviating the needs of underserved populations in developing countries, and additionally serving entrepreneurs who are unable to access traditional financing to help grow their businesses. Again, the Social Success Note has not been extensively tested, it is unclear how many outcome funders will be willing to accept what may be a lower than market rate return on investment, but its potential is promising, particularly for the missing middle social entrepreneurs seeking soft loans.

So What Now?

Tracy Palanjian, the CEO and Founder of Social Finance (the US sister to the SIB creator – Social Finance UK) asked the fundamental question in an address at the 2016 Classy Collaborative, “how do we standardize the work without losing the nuance?” Can the pay for success impact bond pipeline evolve into an approachable mechanism for sustainable development impact capital? Or will the SIB and related spin-offs, which have so many moving parts that need to be redressed at every juncture and within every new deal, complicate themselves out of functionality? Not to mention the implementation challenges of these deals for service providers, such as mission creep, continued partner financial viability, and unforeseeable natural, governmental and human hazards which are often inevitable in the social impact sector.

Organizations like Social Finance and Instiglio are optimistic and working to mitigate those deal structuring challenges, developing reputations as intermediaries who will facilitate the process and ease the frustrations. It now is the sector’s responsibility to actively engage with the arrangements, implementation and results of the ongoing ‘pay for success’ models so that a situation-specific set of best practices can be assembled to relieve the burden of perpetual structural novelty and increase collaboration probability.

As a group, non-profits, social enterprises and social service providers hold a hardscrabble, optimistic, “we-can-do-better” attitude and proliferate the challenging in order to help the underserved. If anyone has the impetus to push this financial model into replicable existence, it is the practitioners who have intimate knowledge of the scope of the global challenges and weigh those against the available capital. The ‘pay for success’ impact bonds don’t just represent an innovation, they represent a lifeline, for service providers and beneficiaries alike.