Pay For Success – Practitioner Perspectives on Deal-Making, Incentivizing and Re-Engineering a Global System

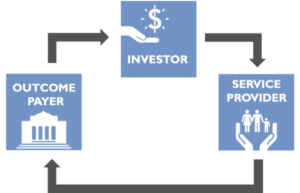

Just under a year ago S3IDF published the blog post Standardize the Work, Don’t Lose the Nuance: Can The New ‘Pay for Success’ Models Replicate Into Functional Utility?, which sought to respond to the frontier trend broadly known as the pay for success model (*Note – it’s worth re-reading that blog to refresh on terms before continuing this post). That blog post perhaps posed more questions than it answered (and this one may as well), but today we have more information, data, statistics and first-hand accounts from 5 panelists presenting on innovative finance in the recent 2017 Harvard Social Enterprise Conference (SECON 2017), which will hopefully answer some of the previously posed questions, and provide further fodder for more nuanced contemplation of the pay for success models.

Instiglio is an open-source aggregator that tracks Social Impact Bonds (SIBs) and Development Impact Bonds (DIBS) in the design and implementation stage for public review. When we last checked in (June of 2016) Instiglio listed roughly 80 SIB/DIB projects, today 120 are enumerated on the website, a 50% increase that promises at least some interesting movement in the sector. Of the 120 listed, 115 are in the ‘implementation stage’, of those 115, 15% are being implemented in the US, 36% in the U.K and only .8% in the Global South (1 project in India). Leading us to the general conclusion that although there are alternative pay for success projects not accounted for in Instiglio’s count that go by other names, such as the innovative Yunus Social Business/Rockefeller Social Success Note Program, or some of the World Bank’s Pay for Results Financing projects (52 approved as of October 2016), thus far the pay for success models are usually finding implementation status in developed countries.

Pay for Success Facilitators’ Updates

At the SECON panel, Innovating Finance to Create Social Impact, a number of salient points were raised by panelists from the following organizations: Accion/CFI, Government Performance Lab, World Bank, Global Strategy Partners, and Social Finance. Their insider perspectives (each of them are directly engaged with facilitating aspects of the pay for success models) are certainly valuable, and worth disseminating more broadly to the S3IDF community for consideration and education.

Standardizing the Language:

DIBs, SIBs, Green Impact Bonds, pay for results, pay for results financing, pay for success, pay for performance, evidence-based funding, results driven contracting, outcome funding. These are just a few of the terms in the cluttered word-scape used by the panelists presenting and others to describe the space of innovative financial mechanisms that seek to leverage private sector capital and tie funding disbursement to impact metrics.

The SECON 2017 presenters and others certainly are a diverse set of actors using a diverse set of terms to discuss what is ostensibly a diverse set of financial models that all stem from a unified general methodology. And while this lack of unified language is not unfamiliar to those of us working in the non-profit and social financial spaces, it does deeply hinder our ability to source information on the evolution of the pay for success models (I’ll use ‘pay for success’ to keep the language consistent with the last blog) and discuss the constraints and opportunities of the models across implementing and facilitating organizations. This laundry list of terms begs the question, would the benefits of streamlining pay for success language help overcome the concept’s high barrier to entry and enhance its reputation, or would it oversimplify a concept which thrives on nuance, flexibility and variation?

“Trying to Find an Outcome Where Everyone’s Equally Happy and Unhappy”

Shu Dar Yao’s (Social Finance) description of the deal negotiations intrinsic to pay for success models represents the essence of any business deal, but can be particularly frustrating when trying to innovate. One major impediment raised by the panelists to finding a balanced ‘outcome’ in the construction of these pay for success deals is the high implementation costs, comprised of high fixed input costs and not-yet reduced transaction costs. The panel’s optimistic, perhaps logical, thinking was that as these models continue to be constructed on the foundation of demonstrable past successful models, the willingness of a variety of investors to initially engage in these conversations and financially commit to the projects will rise, thus lowering the transaction costs.

Further, paired with the burgeoning pay for success model awareness, project facilitators have established innovative methods for engaging otherwise tentative investors. As posited by Danielle Piskadlo of Accion, it is worth pointing out to impact investors that may currently be supporting their own social-first investments through cross-subsidizing their finance-first investments, that they can reduce their dependence on that design through utilizing a pay for success model in their social-first investments. And eventually (when actionable), even finance-first investors may be able to be convinced to invest in smarter, more socially-minded ways, shifting from traditional markets to broader participation in pay for success models.

Shu Dar Yao and Shanthakumar Bannirchelvam (of Global Strategy Partners) also suggested that until more conventional markets, investors and governments are willing to engage with the SIB/DIB model, philanthropic and patient capital is best positioned to act as a catalyst and leveraging tool, helping pay for success models to proliferate. While philanthropic and patient capital enables more immediate pay for success project implementation, the panel grappled with the question of the long-term sustainability of potentially cannibalizing the philanthropic pools to build projects that should be inherently designed to leverage previously un-tapped private and government funding.

Incentivizing (the right and measurable) Behavior

Practitioners operating in the social impact space are familiar with the challenges associated with incentivizing behavior. And every panelist at the session agreed that this was a fundamental challenge innate to the pay for success models, because on the scale that these models are operating (from $250,000 to upwards of $34 million), and within the more rigid pay for success model, you cannot afford to incentivize a wrong and/or unsustainable behavior. There is room for project realignment in traditional impact programs, if something’s not working you change it, but as Ryan Flynn of the World Bank noted, the pay for success models’ outcome funders don’t disburse unless pre-selected specific results are achieved. This has the positive repercussion of drawing people’s attention to those results, but as he also noted, they need to be the right and measurable results.

The pay for success project facilitators face a number of up-front conceptual challenges that were also noted by the panel. They’re tasked with 1. Identifying what activities should be incentivized (to which every party can agree) for the short-term duration of the program, 2. Defining how to measure those incentivized activities, 3. Deciding what metric benchmarks are appropriate for disbursal of funds, and 4. Accounting for how all of this activity could impact the broader community in the long term. The difficulty of tasks 1-3 obviously cannot be ignored, but the importance of task 4 should be further emphasized.

Danielle Piskadlo expounded briefly on the challenge and critical nature of positioning the pay for success program in the design phase within the broader context of potential community impact, national impact, even global impact. The pay for success models are behavior-changing, but if you are creating a project intending to monetize that behavior change, you should be as certain as possible that the behavior you’re incentivizing will drive positive growth and development for the participants, their communities and countries both in the short and long term and will not negatively impact the participants, their communities and the countries both in the short and long term.

The question then becomes how can we take the SIB/DIB model even further to prioritize long-term behavior, examine the behavior change durability and ensure (with all possible agency) that there’s no negative externalities or unintended consequences? And, as one session attendee queried, how can we foster the model and ‘pitch’ that long-term time frame to inherently short-term government/elected official attention spans? A potential solution put forth (and implemented) by Shanthakumar Bannirchelvam is to build in after-program research funding and metrics tracking that help inform both the project long-term impact and future project development.

7 Years to Re-Engineer a System

An attendee question raised during the session drew the panelists to comment on the time for which these bonds have been in operation and judge the expected and met impact relative to that time-frame. It has been roughly 7 years since the first development impact bond was announced. The response from the panelists regarding the perceived success of the model was essentially unified; the incorporation of the pay for success models into the mainstream philanthropic and social sector is a systems-level change. Those take time. And, while there are certainly individuals who say that the pay for success models should demonstrate their own successes within this time-frame to justify their continuing utility and massive investment (over $1 billion at this point), is it not fair to allow the pay for success idea more time to demonstrate proof of concept? Or, alternatively, should we be demanding a near-term expected timeline for a shift towards greater impact results and expanded use of previously untapped private capital in lieu of philanthropic resources (as mentioned above as a catalyzing tool)?

An attendee question raised during the session drew the panelists to comment on the time for which these bonds have been in operation and judge the expected and met impact relative to that time-frame. It has been roughly 7 years since the first development impact bond was announced. The response from the panelists regarding the perceived success of the model was essentially unified; the incorporation of the pay for success models into the mainstream philanthropic and social sector is a systems-level change. Those take time. And, while there are certainly individuals who say that the pay for success models should demonstrate their own successes within this time-frame to justify their continuing utility and massive investment (over $1 billion at this point), is it not fair to allow the pay for success idea more time to demonstrate proof of concept? Or, alternatively, should we be demanding a near-term expected timeline for a shift towards greater impact results and expanded use of previously untapped private capital in lieu of philanthropic resources (as mentioned above as a catalyzing tool)?

The re-orientation of systemic investments in the social and financial space is no small undertaking. And programmatic impact on this scale is measured in years and decades, not months. While this post may have again have raised more questions than provided answers, it is part of a necessary system to both remain informed of innovation trends, and allow new ideas the space to flourish without undue time constraint and scrutiny.